Thus mat credit can be understood as the difference between the tax calculated under the general provisions of the income tax act and that calculated under the mat provisions of the act.

Mat credit entitlement ind as.

This is with effect from ay 2018 19 prior to which mat could be carried forward only for a period of 10 ays.

The maximum amount of mat credit that you can claim cannot exceed the difference between the normal tax liability and the mat liability in the year for which the mat credit is being availed.

The mat ind as committee the committee constituted for this purpose.

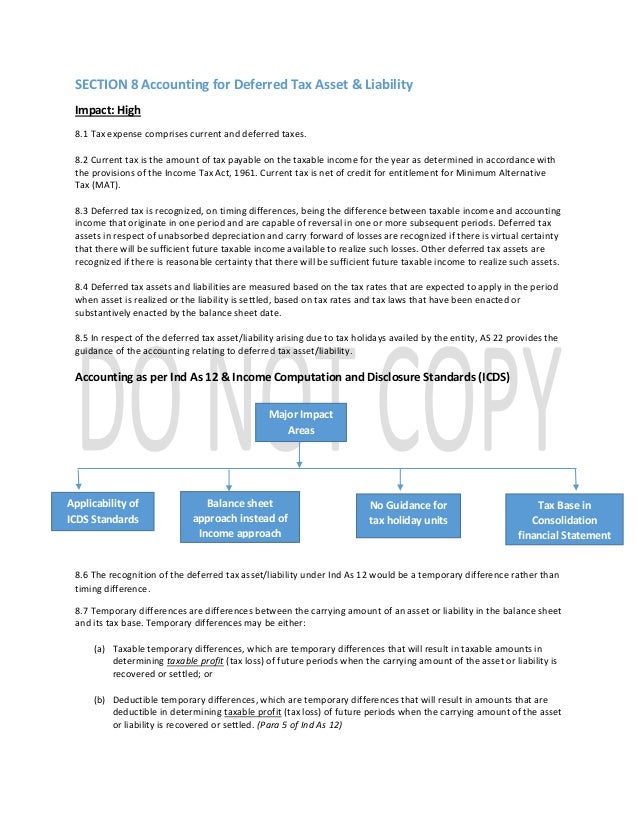

As different accounting treatments have been suggested under previous gaap and ind as for certain transactions the book profit under mat may change.

In our previous publications we provided a broad overview of the mat framework for the computation of book profit for companies required to comply with ind as in the year of adoption and thereafter in the form of frequently asked questions faqs.

1 lakh the tax liability as per the normal provisions for fy 2019 20 is rs.

The format has been taken from division ii of schedule iii to companies act 2013.

Mat credit entitlement a c dr to profit and loss a c with the amount of mat credit available the account head mat credit entitlement should be shown in the balance sheet under the head loans and advances on the assets side.

10 october 2007 in the current year.

Such excess of tax credit is allowed to be carried forward and set off in the financial year in which the company is liable to pay tax under the general.

Therefore the central board of direct taxes cbdt constituted a committee in june 2015 for suggesting the framework for computation of minimum alternate tax mat liability under section 115jb.

They do so by showing the mat credit as mat credit entitlement to the credit of the income and expenditure amount.

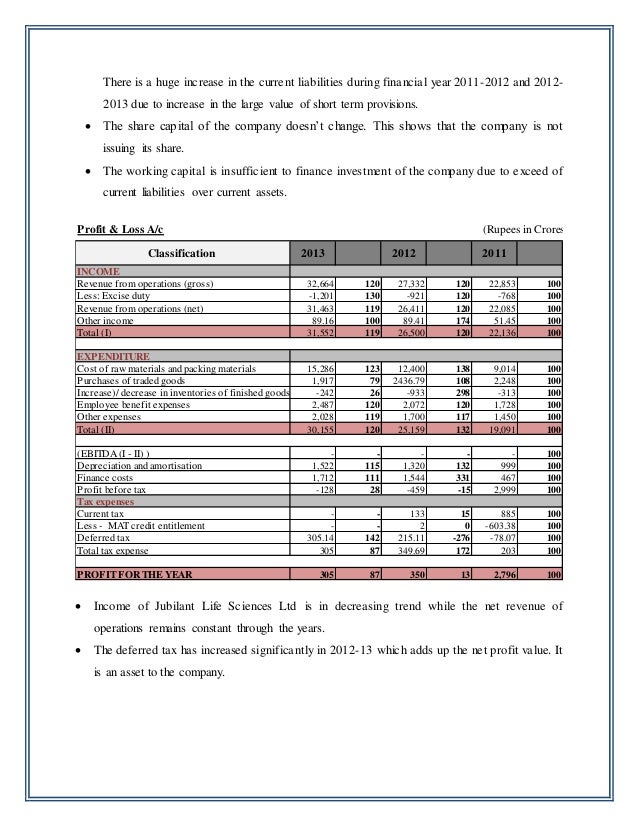

Format of statement of profit loss of ind as compliant companies.

If this circumstance does not arise and mat credit stays in the loans and advances column of the company s balance sheet till the end of the specified period after which it is simply written off.

Rs 14 43 000 rs 12 48 000 rs 1 95 000.

Globally and in india 6 legislative history of alternative minimum tax on companies in india 8 mat rates and regular tax rates for companies 10 mat credit and carry forward mechanism for companies 12 mat on companies and phasing out of tax incentives 16 rationalising mat on companies.

Current challenges and suggestions 18.

In the year of set off of credit the amount of credit availed should be shown as deduction from the provision of taxation on the liabilities side of the balance sheet.

10 lakh while that as per the.

To understand the computation of mat for ind as complaint companies one must know what a statement of profit loss of ind as compliant company looks like.

Such tax credit shall be carried forward for 15 assessment years immediately succeeding the assessment year in which such credit has become allowable.