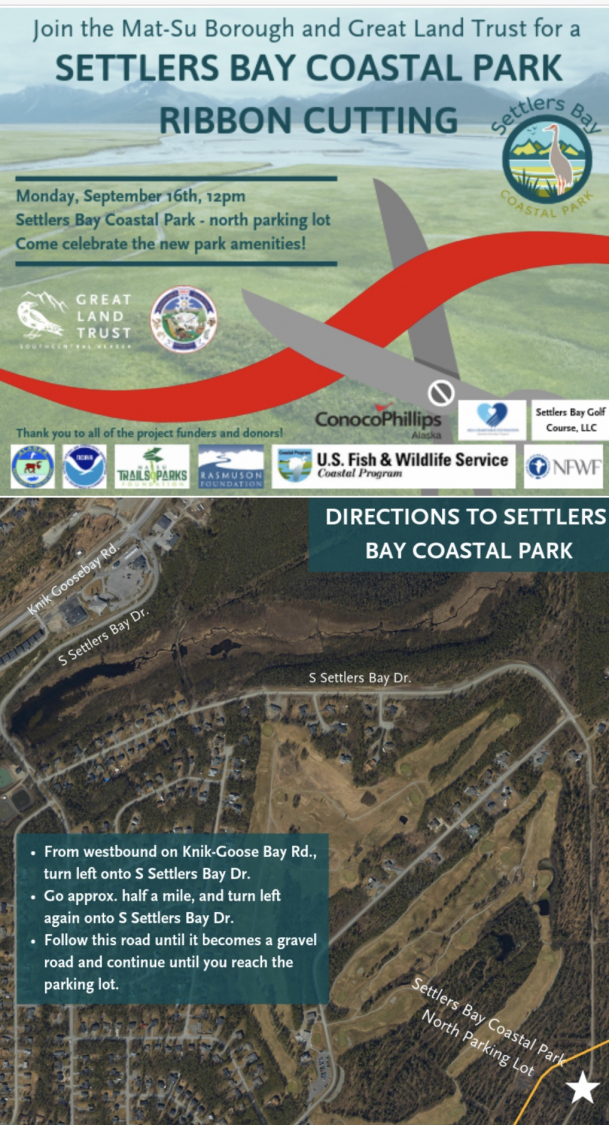

Aircraft registration ambulance fees animal care donations animal care fees bed tax business inventory tax business license fire code fees ice arena fees landfill local improvement district miscellaneous park fees planning fees pools real property tax talkeetna sewer and water tobacco tax.

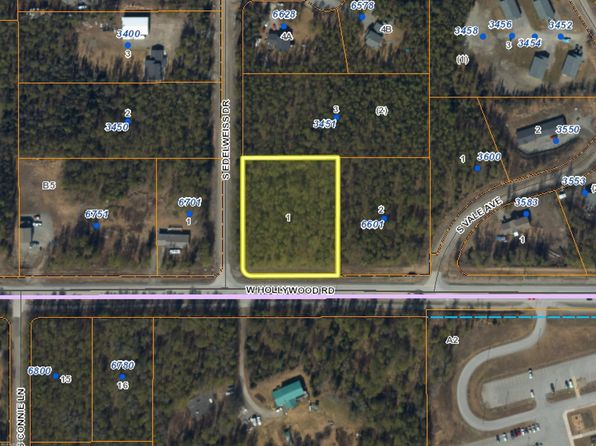

Mat su borough property tax payment.

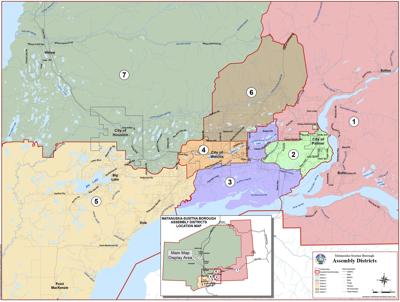

Mat su voters recently adopted an additional property tax exemption for senior citizens disabled veterans.

Matanuska susitna borough has one of the highest median property taxes in the united states and is ranked 292nd of the 3143 counties in order of median property taxes.

Matanuska susitna borough collects on average 1 15 of a property s assessed fair market value as property tax.

Bed tax is collected quarterly.

A tax rate applied to your property s assessed value determines the amount of tax you pay.

You will need a credit card and your tax bill.

To ensure your payment is credited accordingly include the fee payment name in the memo field as well as property identifier.

For taxes paid online a 3 convenience fee is added by the processor.

To pay online use point pay.

The assessor s primary responsibility is to find the full and true value fair market value of your property so that you may pay only your fair share of the tax burden.

Up to 218 000 in value on a primary residence is tax exempt for this group.

Property tax exemption for senior citizens disabled veterans.